Finance

仿真中國金融(rong)(rong)(rong)(rong)市(shi)(shi)場(chang),利用(yong)計算機(ji)技(ji)術開(kai)發虛(xu)(xu)擬市(shi)(shi)場(chang)經濟環境,以(yi)實(shi)體(ti)(ti)(ti)(ti)項(xiang)(xiang)目(mu)投(tou)(tou)(tou)(tou)資(zi)(zi)(zi)(zi)(zi)為目(mu)的(de)(de),涵(han)蓋項(xiang)(xiang)目(mu)投(tou)(tou)(tou)(tou)融(rong)(rong)(rong)(rong)資(zi)(zi)(zi)(zi)(zi)決(jue)策中涉及(ji)的(de)(de)主要(yao)理(li)論(lun)和(he)方(fang)(fang)法(fa),注(zhu)重理(li)論(lun)與實(shi)際相結(jie)合(he),正確的(de)(de)把握金融(rong)(rong)(rong)(rong)決(jue)策。通過(guo)(guo)投(tou)(tou)(tou)(tou)資(zi)(zi)(zi)(zi)(zi)決(jue)策、不確定(ding)性(xing)分(fen)(fen)析(xi)、風(feng)險分(fen)(fen)析(xi)、融(rong)(rong)(rong)(rong)資(zi)(zi)(zi)(zi)(zi)方(fang)(fang)案的(de)(de)相關分(fen)(fen)析(xi)、項(xiang)(xiang)目(mu)評價(jia)以(yi)及(ji)針對(dui)具(ju)體(ti)(ti)(ti)(ti)行(xing)(xing)業的(de)(de)投(tou)(tou)(tou)(tou)融(rong)(rong)(rong)(rong)資(zi)(zi)(zi)(zi)(zi)決(jue)策,融(rong)(rong)(rong)(rong)入近(jin)年來我國基礎設(she)施(shi)建設(she)、房地產、公共(gong)事業項(xiang)(xiang)目(mu)和(he)中外合(he)資(zi)(zi)(zi)(zi)(zi)項(xiang)(xiang)目(mu)的(de)(de)投(tou)(tou)(tou)(tou)融(rong)(rong)(rong)(rong)資(zi)(zi)(zi)(zi)(zi)決(jue)策實(shi)踐新聞來影響股(gu)市(shi)(shi)、債券(quan)、基金等虛(xu)(xu)擬金融(rong)(rong)(rong)(rong)市(shi)(shi)場(chang),充分(fen)(fen)體(ti)(ti)(ti)(ti)現在(zai)投(tou)(tou)(tou)(tou)融(rong)(rong)(rong)(rong)資(zi)(zi)(zi)(zi)(zi)決(jue)策教學(xue)實(shi)踐領域的(de)(de)前瞻性(xing)、內容的(de)(de)新穎性(xing)以(yi)及(ji)方(fang)(fang)法(fa)的(de)(de)實(shi)用(yong)性(xing)。企(qi)(qi)業投(tou)(tou)(tou)(tou)融(rong)(rong)(rong)(rong)資(zi)(zi)(zi)(zi)(zi)是企(qi)(qi)業的(de)(de)財務行(xing)(xing)為,其(qi)決(jue)策就是企(qi)(qi)業的(de)(de)財務戰略。本(ben)軟件(jian)就是為了(le)讓(rang)學(xue)生熟(shu)悉(xi)銀行(xing)(xing)貸款(kuan)、企(qi)(qi)業間貸款(kuan)、民間貸款(kuan)、私募股(gu)權、企(qi)(qi)業上(shang)市(shi)(shi)等融(rong)(rong)(rong)(rong)資(zi)(zi)(zi)(zi)(zi)手段和(he)銀行(xing)(xing)存款(kuan)、債券(quan)、股(gu)票、基金、融(rong)(rong)(rong)(rong)資(zi)(zi)(zi)(zi)(zi)融(rong)(rong)(rong)(rong)券(quan)和(he)房地產投(tou)(tou)(tou)(tou)資(zi)(zi)(zi)(zi)(zi)等投(tou)(tou)(tou)(tou)資(zi)(zi)(zi)(zi)(zi)方(fang)(fang)案,熟(shu)悉(xi)各種(zhong)投(tou)(tou)(tou)(tou)資(zi)(zi)(zi)(zi)(zi)和(he)融(rong)(rong)(rong)(rong)資(zi)(zi)(zi)(zi)(zi)方(fang)(fang)案分(fen)(fen)析(xi),使(shi)學(xue)生更(geng)深的(de)(de)理(li)解投(tou)(tou)(tou)(tou)融(rong)(rong)(rong)(rong)資(zi)(zi)(zi)(zi)(zi)各種(zhong)工具(ju)的(de)(de)使(shi)用(yong)。 并(bing)且通過(guo)(guo)融(rong)(rong)(rong)(rong)資(zi)(zi)(zi)(zi)(zi)和(he)各種(zhong)虛(xu)(xu)擬經濟的(de)(de)投(tou)(tou)(tou)(tou)資(zi)(zi)(zi)(zi)(zi),可以(yi)獲得更(geng)多的(de)(de)流動資(zi)(zi)(zi)(zi)(zi)金,投(tou)(tou)(tou)(tou)入到企(qi)(qi)業的(de)(de)實(shi)體(ti)(ti)(ti)(ti)經濟發展中,從而(er)擴大(da)企(qi)(qi)業的(de)(de)整(zheng)體(ti)(ti)(ti)(ti)規模(mo)。

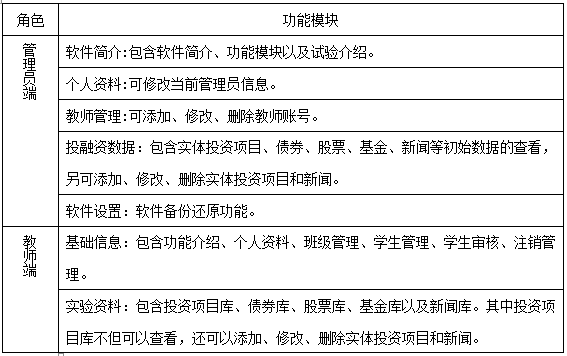

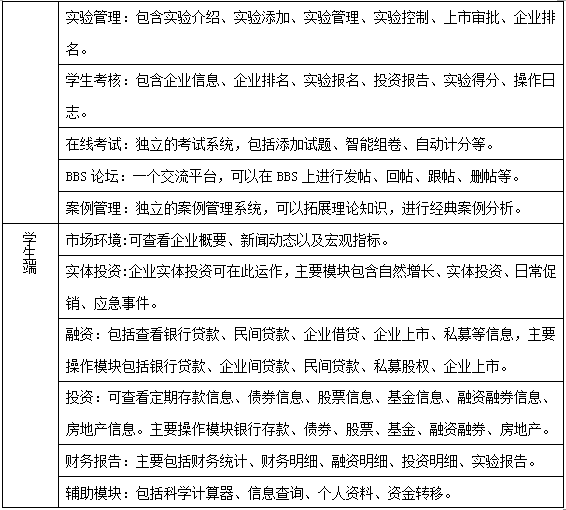

軟件分(fen)為管(guan)理(li)(li)員、教師(shi)和學生(sheng)三層(ceng)管(guan)理(li)(li)結構。管(guan)理(li)(li)員除管(guan)理(li)(li)教師(shi)賬(zhang)號,還需輔助教師(shi)進行實(shi)驗(yan)(yan)基礎數據的(de)設(she)置(zhi)以及系統的(de)管(guan)理(li)(li)維護工作(zuo)。教師(shi)是實(shi)驗(yan)(yan)的(de)發(fa)起(qi)者,設(she)置(zhi)虛擬環(huan)境參數,可實(shi)時查看學生(sheng)的(de)實(shi)驗(yan)(yan)情況。

軟件結構圖:

功能模塊:

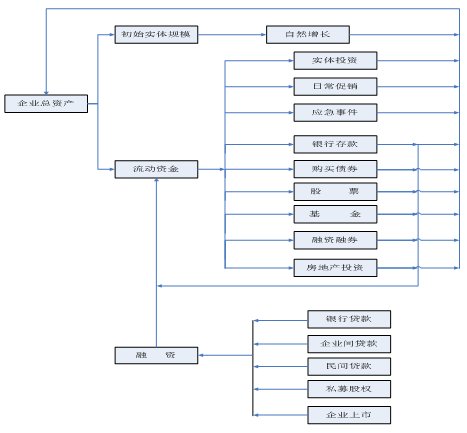

投融(rong)(rong)資(zi)決(jue)策實驗是由學生扮演各種企(qi)業(ye),教師給定(ding)企(qi)業(ye)的初始資(zi)金,分(fen)為固(gu)定(ding)資(zi)產和流動(dong)資(zi)金兩部分(fen),學生可以合理分(fen)配流動(dong)資(zi)金,利用銀行(xing)存款(kuan)、銀行(xing)貸款(kuan)、債(zhai)券、股票、基金、融(rong)(rong)資(zi)融(rong)(rong)券、房地產、企(qi)業(ye)間貸款(kuan)、民(min)間貸款(kuan)、私募(mu)股權(quan)、企(qi)業(ye)上市等投融(rong)(rong)資(zi)手段,積累實體投資(zi)資(zi)金。

資金流:

1.軟件結構簡單,內容豐(feng)富(fu)

系統實(shi)(shi)訓(xun)內(nei)容主要(yao)模(mo)塊包(bao)括市場環境(jing)、實(shi)(shi)體(ti)投資、融資、投資報告以及(ji)財務報告。通過(guo)投資和融資兩類決策(ce)積累資金(jin)(jin),最終進行(xing)(xing)(xing)實(shi)(shi)體(ti)投資。軟件中包(bao)含所(suo)有的(de)投融資方(fang)法,包(bao)括:投資中的(de)銀(yin)行(xing)(xing)(xing)貸(dai)款(kuan)(kuan)、債(zhai)權、股票、基金(jin)(jin)、融資融券(quan)、房地產,融資中的(de)銀(yin)行(xing)(xing)(xing)貸(dai)款(kuan)(kuan)、企業間貸(dai)款(kuan)(kuan)、民間貸(dai)款(kuan)(kuan)、私募股權、企業上市。

2.清(qing)晰的債權(quan)、股票、基金走(zou)勢(shi)圖

隨著宏觀因(yin)素、交易因(yin)素以及新聞因(yin)素的(de)影(ying)(ying)響(xiang),債權、股票、基金(jin)的(de)價格隨之變化。系統根據內置函(han)數顯示債權、股票和基金(jin)的(de)周期(qi)走勢(shi)圖。通過條件搜索查看周期(qi)走勢(shi)圖,結合影(ying)(ying)響(xiang)因(yin)素準確的(de)分析變化趨(qu)勢(shi)。

3.財務(wu)自動統計

提(ti)供財(cai)(cai)(cai)務(wu)(wu)(wu)報告模塊,包(bao)含財(cai)(cai)(cai)務(wu)(wu)(wu)統(tong)計、財(cai)(cai)(cai)務(wu)(wu)(wu)明(ming)細(xi)、融(rong)資(zi)(zi)明(ming)細(xi)、投資(zi)(zi)明(ming)細(xi)。系統(tong)自動統(tong)計并顯示財(cai)(cai)(cai)務(wu)(wu)(wu)的收(shou)支(zhi)圖、財(cai)(cai)(cai)務(wu)(wu)(wu)明(ming)細(xi)、實體資(zi)(zi)金明(ming)細(xi)、流(liu)動資(zi)(zi)金明(ming)細(xi)以及投融(rong)資(zi)(zi)明(ming)細(xi)。實驗者(zhe)可隨時查看財(cai)(cai)(cai)務(wu)(wu)(wu)統(tong)計,便于掌握(wo)資(zi)(zi)金的流(liu)入、流(liu)出。

4.注重教學實踐,仿真市場環境

現(xian)代化(hua)的(de)教學(xue)方法,將所學(xue)的(de)金融知識運(yun)用(yong)到模擬實踐中。通過某種算法將現(xian)實中各指標(biao)變(bian)化(hua)情況(kuang)模擬出來,查看宏觀(guan)指標(biao):GDP增長率走勢(shi)(shi)圖(tu)(tu)(tu)、當年利率走勢(shi)(shi)圖(tu)(tu)(tu)、通貨膨脹率走勢(shi)(shi)圖(tu)(tu)(tu)、信(xin)貸額度調整率走勢(shi)(shi)圖(tu)(tu)(tu)、原油價(jia)格(ge)走勢(shi)(shi)圖(tu)(tu)(tu)、匯(hui)率走勢(shi)(shi)圖(tu)(tu)(tu)等,讓學(xue)生(sheng)了解(jie)整個市場環境(jing)的(de)變(bian)化(hua)情況(kuang)。

5.開放式的管理機制

提(ti)供(gong)教(jiao)師(shi)管理(li)員共同(tong)管理(li)實(shi)驗(yan)基礎數據(ju),教(jiao)師(shi)端可(ke)(ke)以手動控制(zhi)實(shi)驗(yan)的開啟、暫(zan)停。實(shi)驗(yan)中(zhong)教(jiao)師(shi)可(ke)(ke)實(shi)時查看(kan)實(shi)驗(yan)操作日志、得(de)分、企(qi)業排名等(deng)實(shi)驗(yan)相關(guan)過程數據(ju)。在(zai)實(shi)驗(yan)過程中(zhong),教(jiao)師(shi)可(ke)(ke)添(tian)加(jia)投資項目(mu)以及審批企(qi)業上市實(shi)驗(yan)的控制(zhi)。